Old Worries: A Retrospective

Liquified natural gas (LNG) terminals have been in the news a lot lately. Twenty years ago, LNG terminals were also front of mind for the industry. The difference is that today the focus is on export terminals, whereas in 2004, the debate was around LNG import terminals.

If you’ve ever seen There Will Be Blood, you probably have a mental image of what oil and natural gas production looks like. Likely, it involves oil fountaining out of a hole in the ground as soon as someone drills into it. This was not entirely inaccurate to early production – there were plenty of oil and natural gas fields that really were near the surface. However, the Earth’s crust is a big place, and most of our energy resources weren’t located right at the surface.

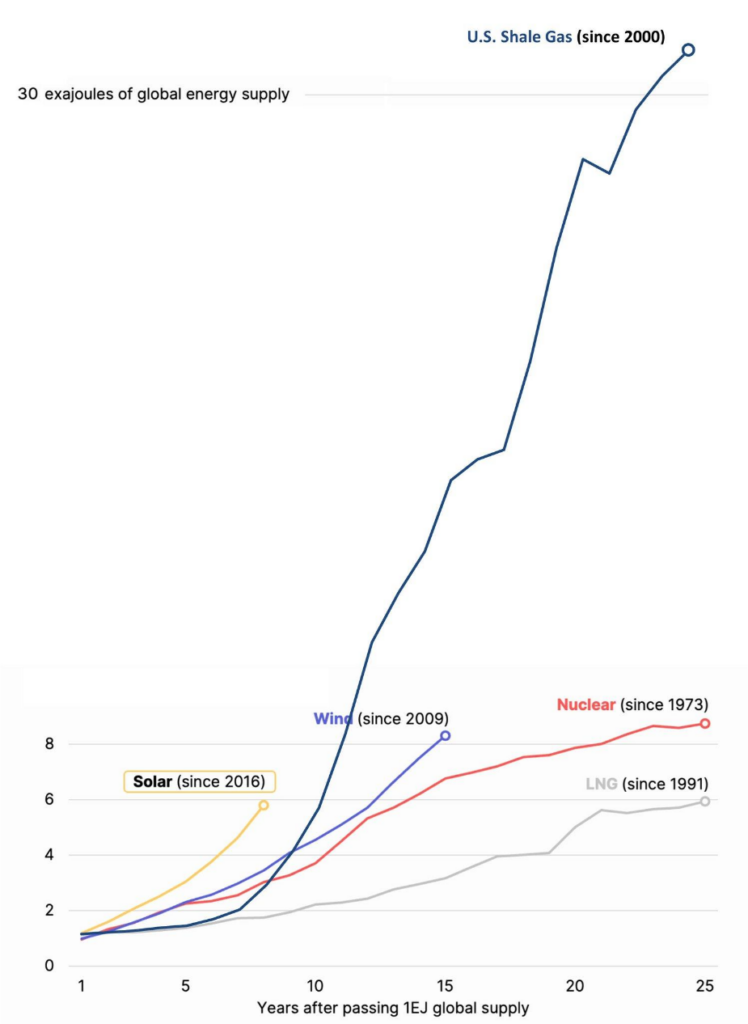

America was early to the game on natural gas extraction. Over the course of roughly a century, the easily accessible energy near the surface was largely extracted. By the late 1990’s, the question facing natural gas utilities was where they were going to get enough natural gas to continue operations, and whether America could build enough LNG import terminals to solve this problem. As the graph below shows, that’s no longer the case.

The Shale Revolution that made the exponential growth of American natural gas pictured above possible was the result of numerous techniques that, taken together, allowed new and previously unviable fields to produce tremendous amounts of natural gas. For more on these techniques, read An Energy Superpower. It made American dependence on foreign energy a thing of the past.

In energy, as during the holidays, it is better to give than to receive. This industry provides almost 10 million American jobs. The natural gas produced in America is the key source for much of our modern fertilizers, and therefore bears responsibility for a huge proportion of our agricultural wealth and food security. Cheaper natural gas means cheaper products made from it – and with more than 6,000 everyday products and high-tech devices made from petrochemicals like natural gas, that translates to a lot of money that stays in your bank account.

American domestic energy production continues to surge, driving costs down for American consumers. As of 2/13/2024, spot prices for natural gas as measured at the Henry Hub had fallen as low as $1.76/MMBtu – about a fifth of current European prices, and under a tenth of the pre-Shale Revolution high of $22.90/MMBtu. Simultaneously, the United States has become the world’s largest exporter of natural gas. Increased use of natural gas at the expense of coal is responsible for 61% of United States electricity grid emissions reductions. As developed and developing countries alike decide what to do with existing coal power plants, American natural gas offers an affordable option for lowering their own greenhouse gas emissions.

We’ve come a long way from the early 2000’s. No longer having to worry about where natural gas can be sourced, and at what costs, have made a tremendous difference for numerous sectors of our economy. Natural gas utility customers have reaped the benefits of domestic natural gas through low bills and average annual savings of $1,132 compared to all electric customers, while American businesses have saved more than half a trillion dollars over the past decade thanks to affordable American natural gas. The transition from supply concerns to an abundance of energy have helped to drive American prosperity. America is well placed to continue this trend far into the future.