Two Decades of Progress – NGMI 500

For more than two decades, the American Gas Association’s biweekly Natural Gas Market Indicators have tracked the state of our industry. With the release of the 500th edition, AGA took the opportunity to look back at how far our industry has come over the last twenty years. In short, the transformation has been profound, greatly benefitting American customers and businesses.

So, what’s changed?

First, American natural gas prices today are a fraction of what they were two decades ago. In 2005, natural gas spot prices at the Henry Hub averaged $13.70/MMBtu in 2024 inflation-adjusted dollars. At the time, the EIA projected that prices would stabilize only slightly below that level, and that the average price would remain around $9.30/MMBtu between 2016 and 2025.

But the Shale Revolution and our nation’s abundant supply of natural gas flipped the script on that projection. From 2016 to 2025 prices were barely one-third of what had been projected, averaging $3.60/MMBtu in 2024 inflation-adjusted dollars. Innovations pioneered by American companies, such as hydraulic fracturing and horizontal drilling, made it economically viable to extract oil and gas from shale deposits, something previously uneconomical. As vast new domestic supplies came online, prices fell sharply.

Lower prices spurred demand, which in turn incentivized increased production and efficiency gains. The virtuous cycle continues to this day and has contributed to historically low prices, with prices reaching an all-time low of $2.19 in 2024 when adjusted for inflation.

Second, the U.S. moved from concerns about supply scarcity to an era of abundance. Before the Shale Revolution, managing supply constraints was a central priority. Major national publications warned that the U.S. was “running out of energy,” and LNG discussions focused largely on imports rather than exports. In 2005, the EIA estimated U.S. natural gas production would be virtually stagnant between 2005 and 2025, projecting barely 4% growth with production peaking around 21 Tcf annually in 2012 before slowly declining to between 19 and 20 Tcf. Instead, U.S. dry gas production is expected to exceed 39 Tcf in 2025 – twice what was anticipated.

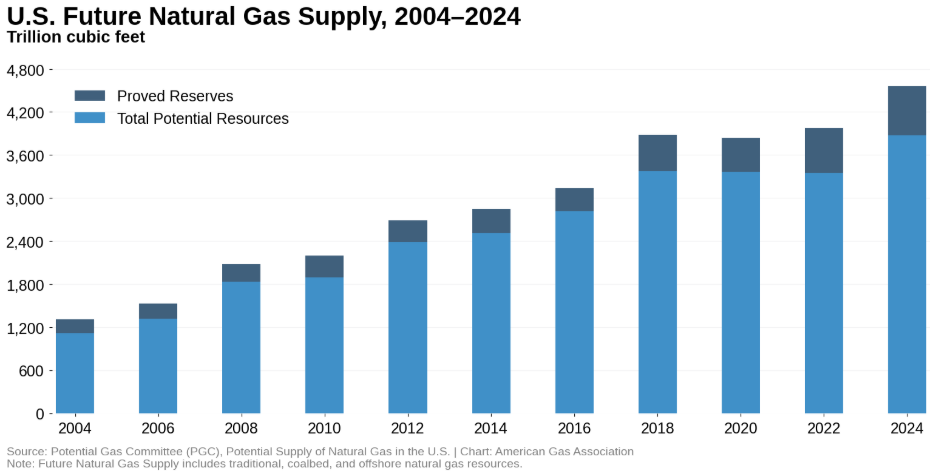

Advances in drilling technology also made more natural gas technically recoverable. Today, continuous innovations in everything from ground penetrating radar to AI algorithms continue to uncover new deposits, with total and proved reserves standing at their highest levels on record.

Third, low-cost natural gas reshaped the U.S. energy system and America’s role in global markets. Power sector demand rose 39% over 2005 projections, with natural gas supply making up more than 40% of U.S. power generation in 2025. This displaced large amounts of coal, lowering costs and emissions alike.

At the same time, residential customer growth continued, climbing an estimated 15% between 2005 and 2025. Investments in energy efficiency by America’s natural gas utilities allowed them to meet this demand without increasing the total amount of natural gas consumed in homes. That translates to lower customer bills, less strain on supply and lower emissions.

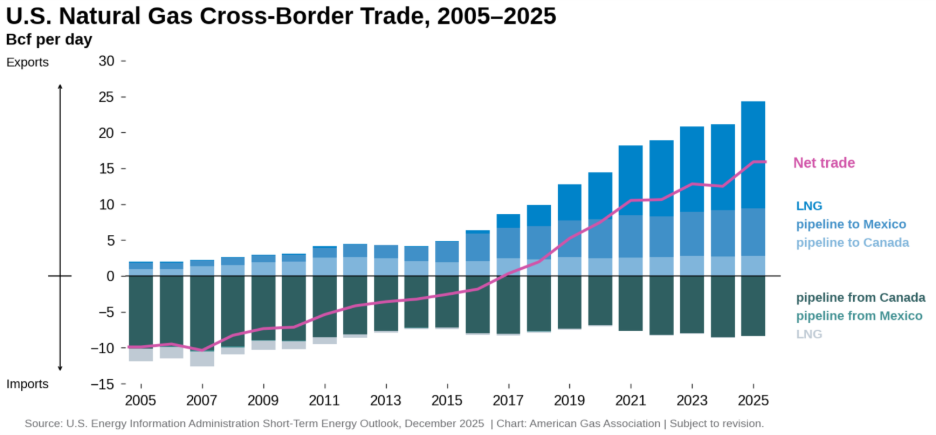

Perhaps most dramatically, America became an export superpower. What had once been characterized by expensive imports became lucrative exports. The U.S. is currently the largest of exporter of LNG in the world, and on track to set a new record in 2025. Cross-border trade with our Mexican and Canadian friends and neighbors likewise surged, with exports to Mexico in 2025 approximately 844% higher than projected in 2005, and imports from Canada 20% lower than projected.

Meeting this export demand was possible without increasing domestic costs thanks to the surging supplies of American natural gas.

Our energy landscape today is far different than anyone imagined it would be two decades ago. What new developments lie ahead? Stay tuned for the next edition, where the Market Indicators team will take a closer look at how today’s forecasts are shaping expectations for the natural gas market in the years to come. To read the entire 500th edition, click here.